The French tax authorities have introduced a new obligation to declare occupancy of property located in France. If you own a property in France, this declaration is compulsory even if you live abroad.

📑 Table of contents

Declaration of occupancy and rent

The first declaration must be made before 30 July 2023. For subsequent years, this section must be kept alive and the declaration amended each time there is a change of tenant or a change in rent. This declaration must be done if you own a property in France, even if you live abroad.

Who is affected by this declaration ?

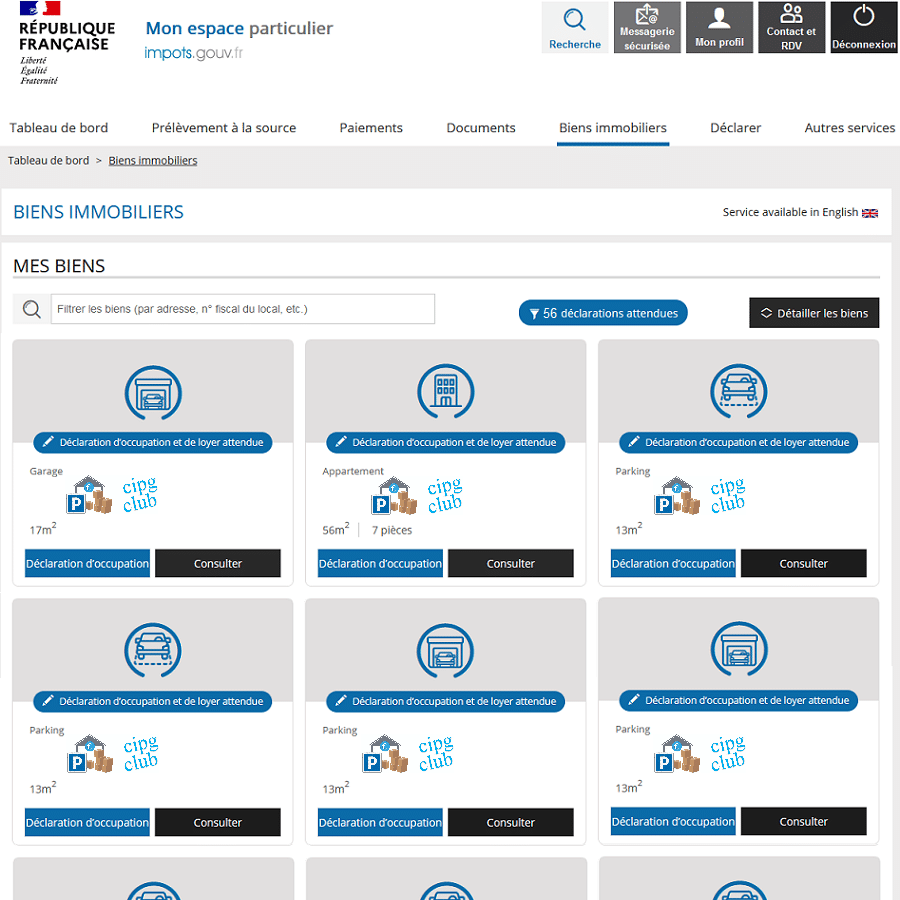

This new tax requirement officially applies to all residential property. Owners of parking spaces and garages were delighted when the text was first read. But then doubts arose, as some club members saw their parking spaces appear in the private section of the tax website.

To declare the occupation of your property, you must complete the required declarations for all the property you own, regardless of its type (flat, house, cellar, storeroom, car park, garage, etc.). Thanks to members of the community, we have contacted several tax centres in different towns and regions of France. All were asked the same question: should a rented parking space or garage be declared as a separate property from a dwelling? All the tax authorities we contacted gave the same answer: you have to complete the occupancy and rent declaration.

By asking further questions, some members of the club have obtained explanations that justify this obligation for some of the properties in the property niche. The tenant of a parking space or garage may be liable for certain taxes. For example, council tax if the tenant’s main residence is less than one kilometre from the parking space.

A legislative text specifies that only business premises subject to council tax are affected by this declaration of occupancy and rent. Industrial buildings, commercial premises and craft premises leased to a company via a company, for example, are not concerned. Although the tax authorities recommend that you complete the declaration of occupancy, several of our members’ chartered accountants have confirmed that you do not need to do so. The tax authorities are obviously trying to obtain as much information as possible, so it’s up to you to provide all the details.

What the French tax authorities expect from landlords

The French tax authorities have a good reason for requiring landlords to declare their occupancy and rent. The official aim is to keep better track of residents and vacant homes. The primary aim is to replenish the state coffers by charging council tax on second homes or vacant accommodation. Another aim is to encourage landlords to rent out their properties in order to reduce the housing shortage.

It’s a shame that no one has thought of introducing a law to better protect landlords. It’s easy to see why people don’t want to rent: there’s a risk of unpaid rent or damage, and landlords are rarely compensated for the loss they suffer. Fortunately, our property niche allows us to create rental leases governed by the civil code, so everyone is well protected and there’s no excuse when a problem arises.

But that’s not all: this new tax obligation will enable the tax office to better track down errors, incomplete or even fraudulent declarations by keeping an inquisitive eye on :

- Enjoyment of a property : this declaration will make it possible to identify who has enjoyment of a property in order to tax it more effectively.

- Monitoring rental income : the declaration enables automated monitoring of rental income and compares it with that declared by each taxpayer.

- Rents charged : thanks to the declaration, the tax authorities will be able to identify all landlords who do not comply with the rules on rent ceilings applied in certain towns and cities.

Risk of misdeclaration

The French’s tax authorities will impose a fixed fine of €150 per property in the event of non-declaration, error, omission or incomplete declaration. However, the Ministry assures us that there will be reminders in the first instance, and that landlords will be treated with a certain degree of benevolence.

How to make a declaration of occupancy

Filing tax returns online on the tax site

The declaration of occupancy is made online on the website of the French Directorate General of Public Finances (DGFiP) : www.impots.gouv.fr. For properties you own in your own name, log on to the “espace particulier”. For properties held through a Société Civile Immobilière (SCI), you need to access the professional area to complete the declaration.

The declaration is made in the “property” section of the tax administration website. This page lists all the properties known to the DGFiP, whether you are an owner, bare owner or usufructuary. The tax authorities have thought of everything, and cellars and storerooms are separated from dwellings so that you can declare any rentals made on storage platforms that declare income in the collaborative economy.

Click on the “Declaration of occupancy” button to start the declaration. You can correct the pre-filled information if it contains errors. If the status of the selected property is correct, click on the “No change” button, otherwise click on “Declare”. For each property, the tax authorities offer you five possible statuses:

- Owner-occupier as main residence,

- Owner-occupier as a second home,

- Vacant property (unfurnished and unoccupied),

- Occupied free of charge,

- Rented.

When the property is rented out, the tax authorities will ask you to confirm the type of rental: bare rental, seasonal rental or professional rental for the choices that concern our property niche.

Next, you need to choose whether your tenant is an individual or a legal entity. Enter the information requested or confirm the information known to the tax authorities.

If you are a foreign national with property in France, you can use the English version of the tax website to file your tax returns.

Pitfalls to avoid for your tax return

Get into the habit of updating your declaration as soon as the situation changes (departure of a tenant who has not been replaced, arrival of a new tenant, new acquisition, etc.) to avoid being in an incomplete situation on 1st July each year, the declaration deadline.

Use the tax authoritie’s secure messaging system to report any errors relating to a property. Although the data displayed is linked to notarial deeds, it is not impossible for an error to remain on the site. As a priority, check the annexes (cellar, balcony, etc.), the measurement (which is different from the Carrez law) and the type of property.

Special cases

Rental management delegated to an agency

Delegating the rental management of a property to an estate agent does not exempt you from making tax returns. As the tax site is a secure, nominative space, you are obliged to enter your tenants’ details yourself.

Property held in joint ownership

For property held in joint ownership, where the right of ownership is shared between several people, only one of the joint owners needs to make the declaration. Don’t forget to agree on who completes the declaration of occupancy.

Property held on leaseback

For property held under a leasehold arrangement, also known as an emphyteutic lease, you are the owner in the eyes of the tax authorities. You must therefore complete the declaration of occupancy.

Divided parking space with several tenants

Some landlords are using the club’s strategies to boost their rental income. One of the strategies explained within the club consists of dividing a parking space to accommodate several tenants. The simplest example is to divide a parking space into 4 spaces for two-wheelers (motorbikes, scooters, etc.). You’ll need to be very precise when declaring your occupancy and rent, and you can find our advice in the taxation section of the forum.

Warehouse divided into storage centre

Another club strategy for obtaining good rental income is to divide up a warehouse and turn it into a storage centre. A simple example would be to divide a 500 m² warehouse into storage units that are rented out to a number of companies and individuals. Declaring occupancy and rent can quickly become complex, so check out our advice in the taxation section of the forum.

Seasonal rental

If you are declaring a property let on a seasonal basis, you do not need to give the names of the occupants. In the case of seasonal lets, it is the landlord who remains liable for Council Tax.

Sale of a property

There is no exemption from declaration after the sale of a property. As long as the property is listed in your online space, its status must be declared. You can mention the date of sale of the property, once the deed of sale has been signed at the notary’s office.

💰 Create and boost your passive income

Property news

1 mail per month

+5000 subscribers